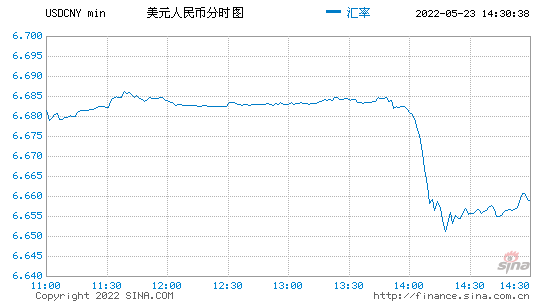

Fluctuated Exchange Rate

On May 21,2022, the central parity rate of RMB exchange rate in China fell from 6.30 at the beginning of March to around 6.75, down 7.2% from the high point of the year at most.

Last Friday (May 20,2022), the interest rate quotation of LPR loans with a term of more than 5 years was reduced by 15bp. With the news of LPR “interest rate cut” landing, the RMB exchange rate rose sharply. On the same day, the spot exchange rate of the onshore RMB against the US dollar broke several barriers in the afternoon and closed at 6.6740, up 938 basis points and 1090 basis points on the week compared with the previous trading day. In the view of insiders, the trend of RMB exchange rate reflects the market’s confidence and expectation of China’s economy. The strong rebound of the RMB has directly benefited from the frequent release of the “steady growth” signal recently.

According to the 21st Century Business Herald, in the view of insiders, the RMB exchange rate at home and abroad has continued to rise since last week, thanks to the decline of the US dollar index from the year’s high of 105.01 to around 103.5, and the stable data of China’s foreign exchange revenue and expenditure in April, which has largely alleviated the financial market’s concern about the sharp decline in the prosperity of China’s foreign trade caused by the epidemic.

For RMB assets, the rapid tightening of the Federal Reserve in the short term and the difference in the direction of monetary policies between China and the United States will put pressure on RMB assets, and asset prices may still fluctuate.” Snow White said that in the medium and long term, RMB assets are still “of sufficient quality” and still have high attraction and investment value for international capital.

Post time: May-23-2022